Valuation Appeal Process

If you wish to appeal the assessment on your property:

Upon receipt of the objection, the Assessor will review the submitted information and schedule a conference to discuss the matter with the property tax payer, and if warranted, will also conduct a review of the property at issue. The Assessor will provide a written response to the objection.

Within thirty (30) days of the Assessor's response, the property taxpayer may appeal to the Oconee County Board of Assessment Appeals ("Board") by providing written notice to the Assessor.

Within thirty (30) days of the receipt of the decision of the board, the property taxpayer may appeal such decision by requesting a contested case hearing before the South Carolina Administrative Law Judge Division.

State Law requires that you must pay 80% of tax calculated on the proposed assessment if it appears that the appeal will not be settled by December 31 of the tax year in question. With a written request, a 100% tax bill can be issued.

Review of assessment may result in any of the following actions: No change, a decreased assessment, or an increased assessment.

Board of Assessment Appeals

The mission of the Oconee County Board of Assessment Appeals is to conduct fair and impartial real property assessment appeal hearings for taxpayers of Oconee County, SC. The Board’s objective is to ensure that appellants’ real properties are assessed at 100 percent of market value, based on properties similar in size and utility, so that an equitable tax burden is shared.

The Board of Assessment Appeals is the next step for property owners to take when they are unable to resolve a valuation issue with the Assessor's Office. The Board will hear the case from both sides: the property owner and a representative from the Assessor's Office. The Board then renders a decision based on evidence presented.

If the property owner and/or Assessor's Office does not agree with the decision, they can file an appeal with the Administrative Law Judge Division in Columbia, South Carolina.

Contact Information for the Board is:

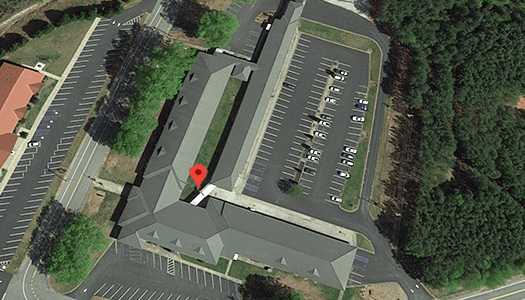

Board of Assessment Appeals

415 S. Pine St

Walhalla, SC 29691

Email: assessorinfo@oconeesc.com

Phone: (864) 638-4150